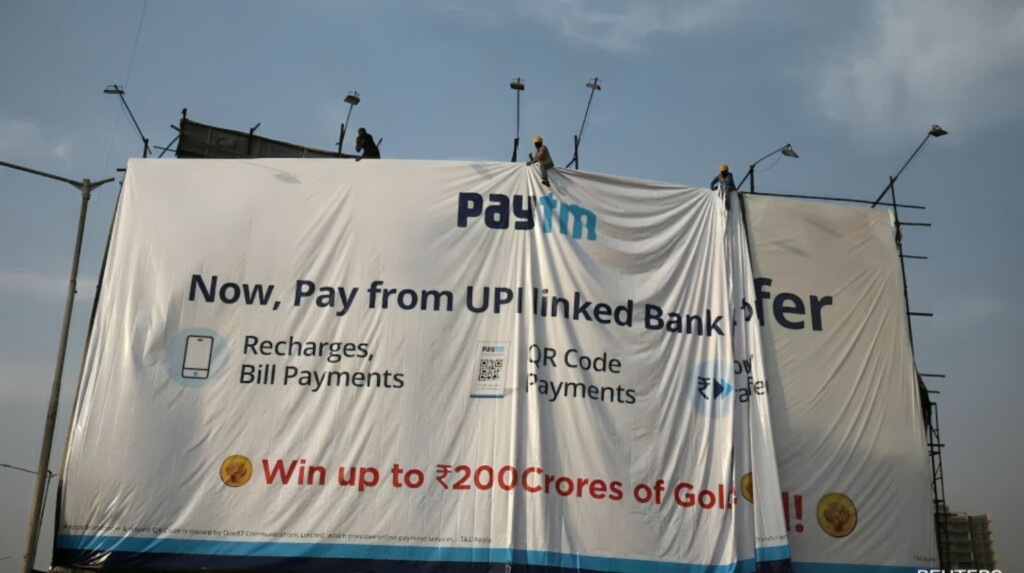

In compliance with a directive from the Reserve Bank of India (RBI), Paytm Payments Bank has been instructed to cease the acceptance of new deposits into its accounts and widely used digital wallets starting from March. The regulatory decision signifies a measure aimed at ensuring adherence to specified guidelines and financial protocols.

In Bengaluru, the shares of Paytm, a digital payments firm, witnessed a sharp 20% decline on Friday, following the persistent impact of a central bank crackdown on its payments bank. Despite the company’s efforts to allay concerns about potential repercussions on its business, investor sentiment continued to be affected negatively. Paytm shares hit 487 rupees, marking their lowest point in over a year, remaining at the lower limit of a trading band imposed by the exchange for the second consecutive day. This week alone, the company’s shares have experienced a significant 36% decline.

Paytm CEO Vijay Shekhar Sharma sought to reassure users in a post on Friday, emphasizing the normal functioning of the app beyond February 29. Despite the ongoing challenges, Sharma expressed confidence in the company’s ability to navigate and continue serving the nation in full compliance with regulatory requirements.

The Reserve Bank of India (RBI) had issued a directive on Wednesday instructing Paytm Payments Bank to halt the acceptance of new deposits in both its accounts and popular digital wallets starting from March. This regulatory move has raised concerns regarding the potential impact on revenues from Paytm’s core payments business.