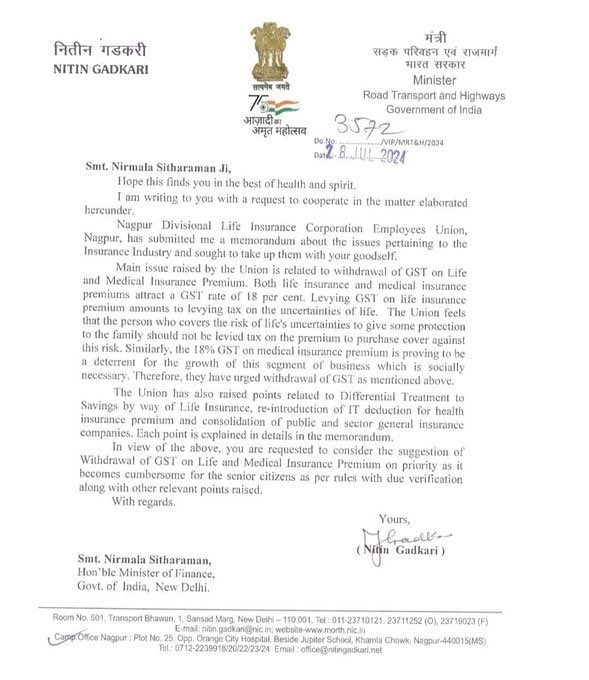

Union Minister for Road, Transport and Highways, Nitin Gadkari, has called upon Finance Minister Nirmala Sitharaman to eliminate the 18 percent Goods and Services Tax (GST) imposed on life and medical insurance premiums. He argues that this tax burdens individuals with the uncertainties of life and hinders the growth of the insurance sector, as reported by Moneycontrol on Wednesday, July 31. In a letter dated July 28, Gadkari emphasized the need for prioritizing the removal of GST on these premiums, particularly highlighting the difficulties it poses for senior citizens.

At present, life and medical insurance premiums are subject to an 18 percent GST charge. Nitin Gadkari stated that the tax imposed on medical insurance premiums is hindering the industry’s expansion and also affecting society.

Nitin Gadkari, the Member of Parliament for the Nagpur constituency in the Lok Sabha, responded to the concerns raised by the Nagpur Divisional Life Insurance Corporation Employees Union. According to a report by Moneycontrol, the Union had submitted a memorandum to the road and transport minister highlighting the challenges faced by the insurance industry. In his letter, Gadkari expressed that imposing GST on life insurance premiums equates to taxing the uncertainties of life. He emphasized that individuals who provide protection to their families by covering life’s risks should not be taxed on the premiums paid for this coverage.

The issue of “differential treatment of savings through life insurance, reintroduction of income tax deduction for health insurance premiums, and consolidation of public sector general insurance companies” was also emphasized by the union minister. The GST Council, last convened on June 22, is scheduled to convene again in August. This council, a constitutional body, provides recommendations concerning the implementation of the Goods and Services Tax (GST) in India.

Leave a Reply