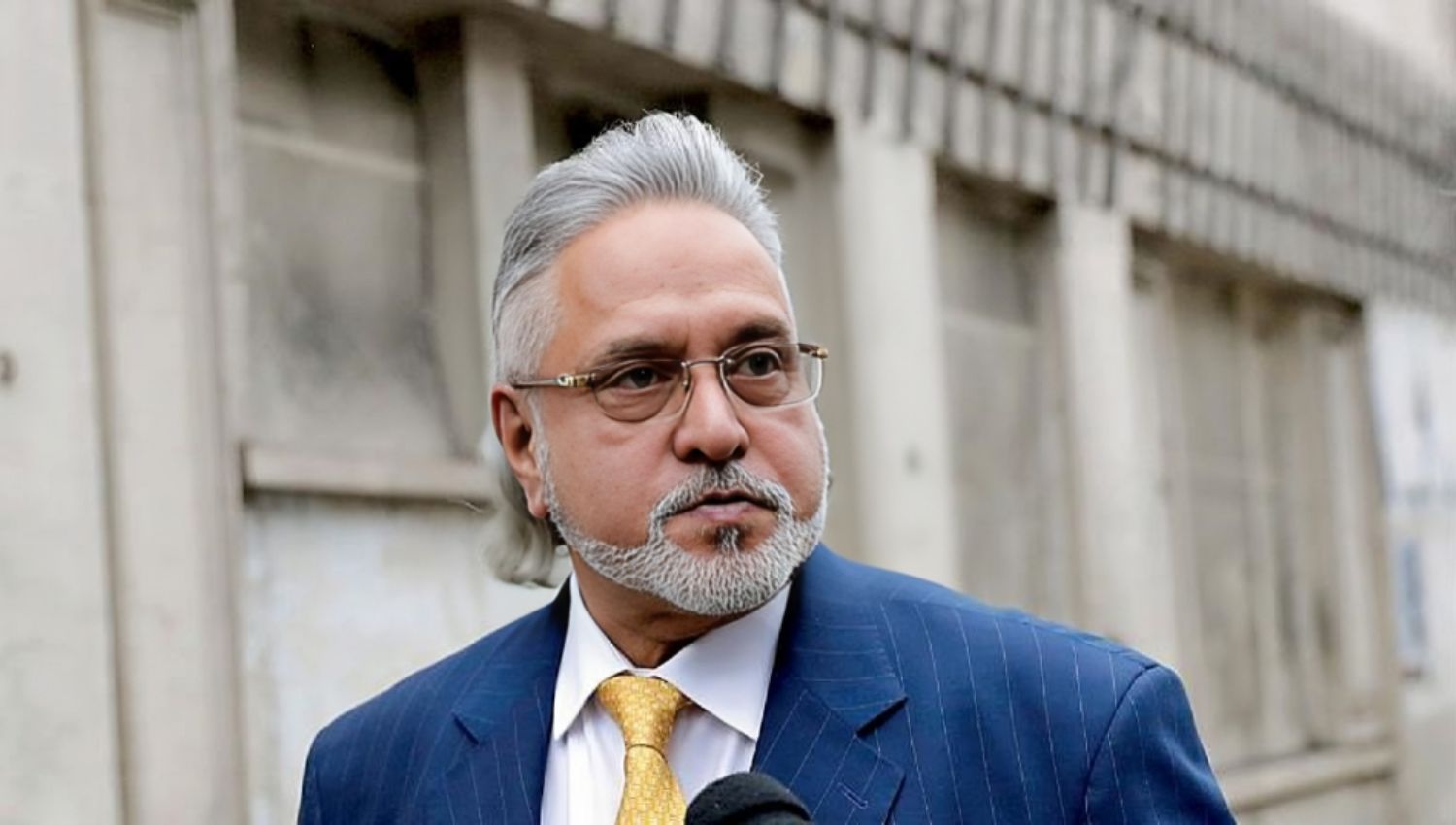

India’s markets regulator, Securities and Exchange Board of India (Sebi), has recently issued an order that prohibits fugitive businessman Vijay Mallya from participating in the securities market for a period of three years. This decision was made after discovering that Mallya had channeled funds into the Indian securities market using intricate transactions to conceal his identity.

Anitha Anoop, the chief general manager at Sebi, revealed that Mallya, the former head of United Breweries and the majority shareholder of United Spirits Ltd (USL), devised a plan to indirectly trade shares of his own companies. These transactions were conducted through bank accounts at UBS AG London, making use of the Foreign Institutional Investment (FII) route.

The actions in question are not only deceitful and misleading but also pose a risk to the integrity of the securities market, as stated in the Sebi order. This is not the first time Mallya has faced penalties; Sebi had previously prohibited him from participating in the securities market for a period of three years, commencing on 1 June 2018, due to manipulative practices and inappropriate dealings in USL shares.

In Friday’s ruling, Sebi stressed that Mallya had been involved in manipulative and fraudulent activities and was engaging in unfair trade practices, which constituted a violation of securities laws. This led the regulator to extend his market ban for another three years. The regulator had initiated an investigation suo motu based on information from the Financial Services Authority (FSA).

The probe revealed that Mallya used Matterhorn Ventures, a registered sub-account of an FII—Matterhorn Advisory Singapore Pte Ltd—to indirectly trade in the shares of his group companies, Herbertsons and USL, in India. The funds were routed through various beneficiary accounts with UBS and then funneled into the Indian securities market.

The Sebi order highlighted that Mallya was the ultimate beneficial owner of multiple accounts, including Bayside, Suncoast, and Birchwood. These entities transferred a total of $6.15 million to Venture New Holding Ltd, which Mallya also owned. The funds were immediately used to purchase shares of Herbertsons. After Herbertsons merged with USL, Matterhorn Ventures received 633,333 shares of USL in exchange for 950,000 shares of Herbertsons, at a 2:3 exchange ratio, in 2006. Sebi’s Anoop noted that Mallya’s abuse of the FII regulations framework was harmful to investors.

“I find that the said acts of Mallya in abusing the framework of the FII Regulations and dealing in securities of listed companies of his group of companies in India, indirectly, in a fraudulent manner and by employing a manipulative and deceptive artifice, thereby, indulging in purchase and sale of securities of Herbertsons/USL clearly was detrimental to the investors at large and was with an intention to deceive the market players in violation of the PFUTP Regulations and SEBI Act,” the order read.

Leave a Reply